Accounting Books And Records . These records must be kept for two main purposes: Accounting records are the original source documents, journal entries, and ledgers that. There are generally two types of accounting records: Download the record keeping checklist (pdf, 61kb) to ensure that your company has maintained the required. You should keep proper records and accounts for 5 years so that the income earned and business expenses claimed can be readily determined. The single entry is easier and more manageable for. Accounting records refer to organized and methodical documentation of a business’s financial transactions to create an audit trail and ensure compliance. In singapore, it is compulsory for companies to keep proper records and accounts of their business transactions. Accounting records are specific accounting documents that detail business income and expense transactions.

from www.vrogue.co

Accounting records are the original source documents, journal entries, and ledgers that. Accounting records are specific accounting documents that detail business income and expense transactions. You should keep proper records and accounts for 5 years so that the income earned and business expenses claimed can be readily determined. These records must be kept for two main purposes: Download the record keeping checklist (pdf, 61kb) to ensure that your company has maintained the required. In singapore, it is compulsory for companies to keep proper records and accounts of their business transactions. There are generally two types of accounting records: The single entry is easier and more manageable for. Accounting records refer to organized and methodical documentation of a business’s financial transactions to create an audit trail and ensure compliance.

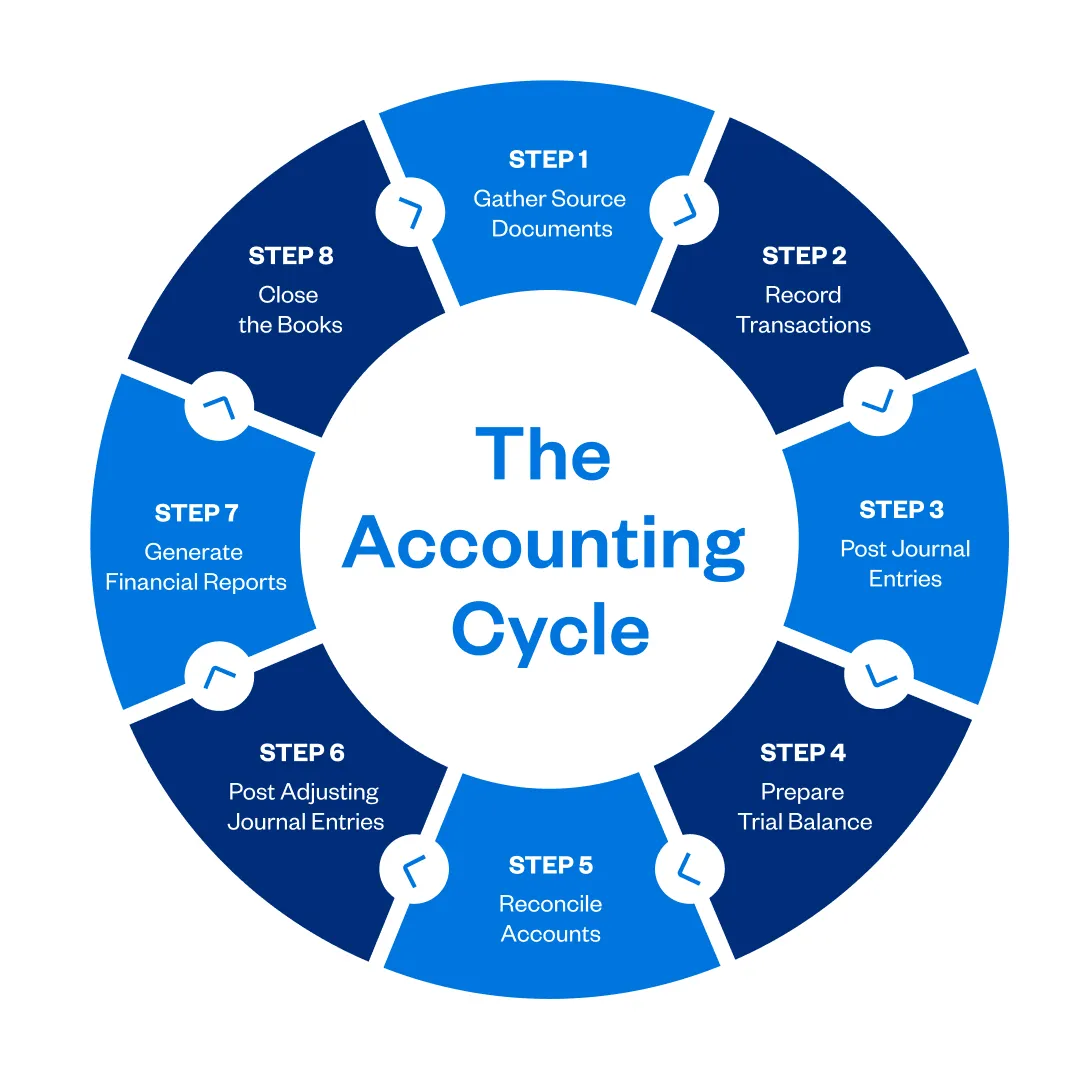

What Is The Accounting Cycle Definition Steps Example vrogue.co

Accounting Books And Records There are generally two types of accounting records: There are generally two types of accounting records: Accounting records are specific accounting documents that detail business income and expense transactions. Download the record keeping checklist (pdf, 61kb) to ensure that your company has maintained the required. Accounting records are the original source documents, journal entries, and ledgers that. The single entry is easier and more manageable for. Accounting records refer to organized and methodical documentation of a business’s financial transactions to create an audit trail and ensure compliance. In singapore, it is compulsory for companies to keep proper records and accounts of their business transactions. You should keep proper records and accounts for 5 years so that the income earned and business expenses claimed can be readily determined. These records must be kept for two main purposes:

From studylib.net

Chapter 3 Accounting Books and Records Accounting Books And Records In singapore, it is compulsory for companies to keep proper records and accounts of their business transactions. You should keep proper records and accounts for 5 years so that the income earned and business expenses claimed can be readily determined. The single entry is easier and more manageable for. These records must be kept for two main purposes: Accounting records. Accounting Books And Records.

From shieldbetta.weebly.com

Bookkeeping software for home use shieldbetta Accounting Books And Records These records must be kept for two main purposes: Accounting records are specific accounting documents that detail business income and expense transactions. You should keep proper records and accounts for 5 years so that the income earned and business expenses claimed can be readily determined. Accounting records are the original source documents, journal entries, and ledgers that. There are generally. Accounting Books And Records.

From ztabs.co

Best Accounting Books for Small Business Accounting Books And Records Accounting records are the original source documents, journal entries, and ledgers that. In singapore, it is compulsory for companies to keep proper records and accounts of their business transactions. Accounting records are specific accounting documents that detail business income and expense transactions. Accounting records refer to organized and methodical documentation of a business’s financial transactions to create an audit trail. Accounting Books And Records.

From alexgilbert.z13.web.core.windows.net

Bookkeeper Chart Of Accounts Accounting Books And Records You should keep proper records and accounts for 5 years so that the income earned and business expenses claimed can be readily determined. Accounting records are the original source documents, journal entries, and ledgers that. The single entry is easier and more manageable for. In singapore, it is compulsory for companies to keep proper records and accounts of their business. Accounting Books And Records.

From members.ascassociation.org

Product Detail Accounting Books And Records There are generally two types of accounting records: The single entry is easier and more manageable for. These records must be kept for two main purposes: Accounting records are specific accounting documents that detail business income and expense transactions. Download the record keeping checklist (pdf, 61kb) to ensure that your company has maintained the required. Accounting records are the original. Accounting Books And Records.

From www.bigstockphoto.com

Old Accounting Records Image & Photo (Free Trial) Bigstock Accounting Books And Records In singapore, it is compulsory for companies to keep proper records and accounts of their business transactions. There are generally two types of accounting records: You should keep proper records and accounts for 5 years so that the income earned and business expenses claimed can be readily determined. Download the record keeping checklist (pdf, 61kb) to ensure that your company. Accounting Books And Records.

From powermaxph.com

PROPER HANDLING OF BOOKS OF ACCOUNTS AND OTHER ACCOUNTING RECORDS Accounting Books And Records Accounting records are the original source documents, journal entries, and ledgers that. The single entry is easier and more manageable for. There are generally two types of accounting records: Accounting records refer to organized and methodical documentation of a business’s financial transactions to create an audit trail and ensure compliance. You should keep proper records and accounts for 5 years. Accounting Books And Records.

From www.walmart.com

Accounting Ledger Book Simple Accounting Ledger for Bookkeeping Accounting Books And Records Accounting records refer to organized and methodical documentation of a business’s financial transactions to create an audit trail and ensure compliance. The single entry is easier and more manageable for. You should keep proper records and accounts for 5 years so that the income earned and business expenses claimed can be readily determined. Download the record keeping checklist (pdf, 61kb). Accounting Books And Records.

From passnownow.com

Introduction to Book keeping and Account Passnownow Accounting Books And Records The single entry is easier and more manageable for. In singapore, it is compulsory for companies to keep proper records and accounts of their business transactions. There are generally two types of accounting records: These records must be kept for two main purposes: You should keep proper records and accounts for 5 years so that the income earned and business. Accounting Books And Records.

From www.superfastcpa.com

What are Accounting Records? Accounting Books And Records Accounting records are the original source documents, journal entries, and ledgers that. These records must be kept for two main purposes: Accounting records are specific accounting documents that detail business income and expense transactions. Accounting records refer to organized and methodical documentation of a business’s financial transactions to create an audit trail and ensure compliance. In singapore, it is compulsory. Accounting Books And Records.

From www.pinterest.com

+10 Free Financial Accounting Books [PDF] in 2022 Accounting books Accounting Books And Records The single entry is easier and more manageable for. Accounting records refer to organized and methodical documentation of a business’s financial transactions to create an audit trail and ensure compliance. These records must be kept for two main purposes: There are generally two types of accounting records: Accounting records are the original source documents, journal entries, and ledgers that. In. Accounting Books And Records.

From db-excel.com

Accounting Spreadsheet Templates Hynvyx in Church Bookkeeping Accounting Books And Records Download the record keeping checklist (pdf, 61kb) to ensure that your company has maintained the required. In singapore, it is compulsory for companies to keep proper records and accounts of their business transactions. Accounting records refer to organized and methodical documentation of a business’s financial transactions to create an audit trail and ensure compliance. Accounting records are specific accounting documents. Accounting Books And Records.

From ansi.ph

7 Tips for Better Financial Records ANSI Information Systems Accounting Books And Records In singapore, it is compulsory for companies to keep proper records and accounts of their business transactions. Accounting records refer to organized and methodical documentation of a business’s financial transactions to create an audit trail and ensure compliance. Accounting records are specific accounting documents that detail business income and expense transactions. You should keep proper records and accounts for 5. Accounting Books And Records.

From www.walmart.com

Accounting Ledger An Accounting Notebook for Bookkeeping Record Book Accounting Books And Records You should keep proper records and accounts for 5 years so that the income earned and business expenses claimed can be readily determined. Accounting records are specific accounting documents that detail business income and expense transactions. Accounting records are the original source documents, journal entries, and ledgers that. The single entry is easier and more manageable for. In singapore, it. Accounting Books And Records.

From www.thewowstyle.com

The Benefits of Updated Bookkeeping and Accounting Records Accounting Books And Records These records must be kept for two main purposes: Accounting records refer to organized and methodical documentation of a business’s financial transactions to create an audit trail and ensure compliance. Accounting records are specific accounting documents that detail business income and expense transactions. In singapore, it is compulsory for companies to keep proper records and accounts of their business transactions.. Accounting Books And Records.

From www.walmart.com

Accounting Record Book 100 Pages, 3 Column Ledger (Paperback Accounting Books And Records In singapore, it is compulsory for companies to keep proper records and accounts of their business transactions. There are generally two types of accounting records: The single entry is easier and more manageable for. Accounting records are specific accounting documents that detail business income and expense transactions. Download the record keeping checklist (pdf, 61kb) to ensure that your company has. Accounting Books And Records.

From corporatehub.hk

Top 5 Benefits of Keeping Proper Accounting Records Corporate Hub Accounting Books And Records These records must be kept for two main purposes: You should keep proper records and accounts for 5 years so that the income earned and business expenses claimed can be readily determined. Accounting records are specific accounting documents that detail business income and expense transactions. There are generally two types of accounting records: Accounting records refer to organized and methodical. Accounting Books And Records.

From www.vrogue.co

What Is The Accounting Cycle Definition Steps Example vrogue.co Accounting Books And Records You should keep proper records and accounts for 5 years so that the income earned and business expenses claimed can be readily determined. These records must be kept for two main purposes: Accounting records refer to organized and methodical documentation of a business’s financial transactions to create an audit trail and ensure compliance. The single entry is easier and more. Accounting Books And Records.